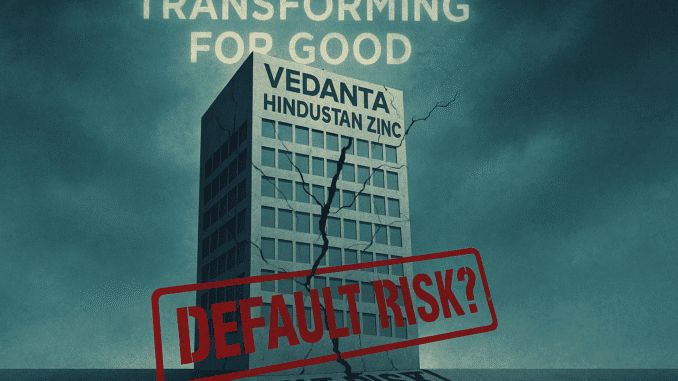

Vedanta’s PR machine is roaring, but the ground beneath its empire is trembling.

The SanvaadGarh | Delhi

In a fresh blow to Anil Agarwal’s corporate conglomerate, U.S.-based forensic financial firm Viceroy Research has publicly accused Vedanta’s subsidiary Hindustan Zinc of breaching financial covenants that could trigger a default under international bond agreements.

This comes barely weeks after Vedanta launched an expansive “Transforming for Good” advertisement campaign broadcasting claims of sustainability, progress, and ESG alignment across platforms, including newspapers, hoardings, and digital media. The ad hailed Vedanta as a “partner in India’s green transformation.” But watchdogs say otherwise.

What Viceroy Research Exposed:

According to the report accessed by The SanvaadGarh, Viceroy alleges:

- Hindustan Zinc issued undisclosed guarantees in favor of Vedanta Resources Limited (its London-listed parent).

- These backdoor financial maneuvers risk violating debt agreements tied to Vedanta’s bonds.

- If bondholders act on these violations, it may trigger a technical default, putting not just HZL, but the wider Vedanta Group in jeopardy.

“If confirmed, this breach of covenant opens the door to bondholders calling in billions. Vedanta is playing a high-stakes shell game,” – Viceroy Research.

The Financial Domino:

This isn’t the first red flag around Vedanta’s liquidity:

- In 2023, rating agencies flagged Vedanta’s heavy debt burden.

- The group has repeatedly transferred cash from Hindustan Zinc to service its international liabilities.

- Despite this, Vedanta continues to issue advertisements claiming financial discipline and green credentials.

Greenwashing at Its Peak?

At The SanvaadGarh, we had earlier exposed Vedanta’s ad blitz in Korba, which aired in government events and civic functions, despite pending environmental cases, pollution fines, and fly ash contamination near its BALCO plant.

Read the full story : https://sanvaadgarh.in/vedantas-green-promises-vs-korbas-ash-reality/

Now, this financial bombshell raises a simple question:

Is Vedanta hiding behind ads while its empire sinks under debt and deceit?

Questions That Need Answers:

- Why hasn’t SEBI taken cognizance of these serious allegations yet?

- What role is the Ministry of Corporate Affairs playing in regulating the financial governance of public-sector linked entities like HZL?

- Should PSUs like Hindustan Zinc remain under partial government control when being used to bail out private conglomerates?

Vedanta’s story now goes far beyond pollution and PR it’s about financial opacity, potential defaults, and systemic risk. As India bets big on private sector growth, who’s watching the watchdogs?

At The SanvaadGarh, we will.

Be the first to comment